Digital Display Advertising Insights for Real Estate

The way people are moving has changed. From initial search through final transaction, nearly every step of the real estate journey has become digitized. Consumers rely on the web as their main source of information, making digital advertising—which was once a marketing tactic—now a primary business strategy.

This month we distill the eMarketer US Digital Display Advertising 2020 report for snackable and actionable marketing insights specific for the real estate industry. From video, banners, social, connected TV, mobile, and native, the report breaks down digital display advertising spend throughout this disruptive year.

**Note: Display advertising does not account for search. Search roughly accounts for 50% of total digital advertising, with display representing the other 50%.**

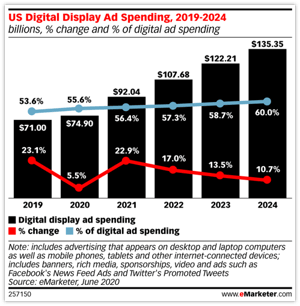

1. Display advertising is driving growth, with investments 3x higher than total digital spend

While total digital advertising will only grow 1.7% this year due to coronavirus and the recession, display advertising (digital banners and videos) will see an increase of 5.5%—equating to nearly $75B. Mobile accounts for 7 out of 10 digital display ads, with desktop experiencing a steady decline.

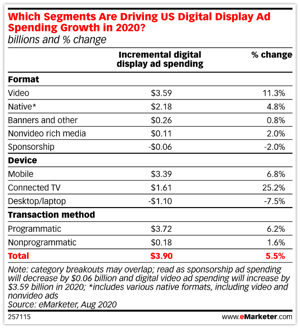

2. Video and connected TV are main segments driving digital display growth

.png?width=300&name=unnamed%20(14).png)

3. Facebook & Google remain leading digital display ad sellers

Despite being the largest digital ad sellers, Facebook and Google are posing new challenges to real estate brands who can no longer target their prospects as well as they could years ago. New kid on the block Amazon is growing exponentially, with ad technology that allows retail brands selling on Amazon to retarget shoppers across the web. Despite its unrivaled data on consumer spending habits, it has not broken through as a useful ad platform for real estate...yet.

How to use this information: Benchmark your advertising spend to this data. Growing US industries (like real estate) are increasing their digital display ad investments, specifically on mobile devices and TVs using programmatic targeting technologies. How does your current strategy and media mix compare?

Want even more insights? Reach out and one of our team members would be happy to walk you through the full report and other key industry research and metrics.