Google in the Real Estate Marketing Ecosystem

Read Time 8 mins | Sep 30, 2020 10:36:49 AM | Written by: Ed Carey

Google. Friend? Enemy? Frenemy?

We all know Google. But do we really KNOW Google.

Let’s peel back a few layers of Google’s business to understand just what exactly Google’s role is as a vendor to the real estate lead generation sector and why it keeps finding itself in the hot seat with lawmakers and consumers.

The world’s 4th largest company, Alphabet, is built from people clicking on ads that are so relevant to their interests they are mistaken for content.

Google is the advertising division of Alphabet, the 4th largest company in the world ($817B). Google generates the majority ($120B) of Alphabet’s revenue ($170B). And Google still earns most of its revenue from text ads that brands pay for when people click on the sponsored links of a search result.

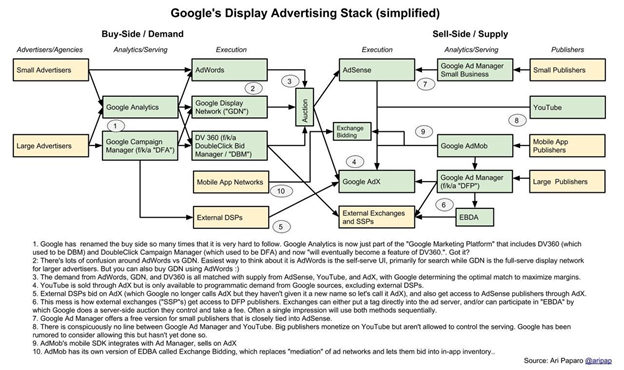

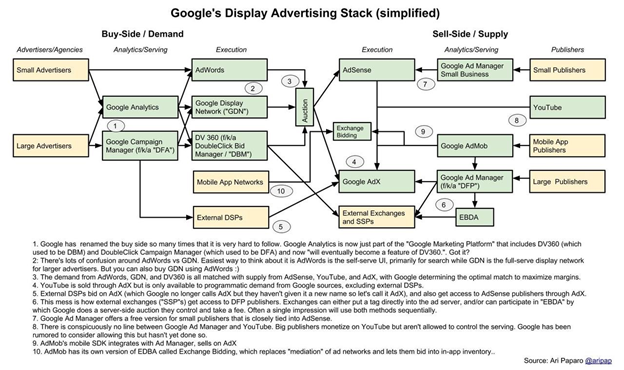

Google also operates a sprawling amusement park of display advertising products (banners, videos, mobile ads) that feed off the consumer search data intent signals and drive very good advertising performance for marketers, and very good monetization for media publishers.

Google owns myriad consumer properties like Google search, Gmail, Chrome browser, Google applications, and YouTube—the biggest video site on the planet ($15B). But those are just the products consumers see. What they don’t see is the “invisible” technology and operating systems owned and operated by Google, the “plumbing”, that almost every buyer and seller of advertising uses. These “pipes” control the flow of money and data across the entire web ecosystem—Android, DV360, AdMob, AdSense and AdX, to name a few.

Below is a map of Google’s display advertising system, in addition to which there are search, mobile, and content systems that spiral into an advertising turbine that churns out cash:

When a company earns money selling ads that consumers see and advertisers pay for, that makes you a media company, like NBC or Facebook or Zillow Group.

Google’s consumer media products like YouTube, and their “invisible” technology like Android, are enabled by incredible computing power and data science, so Google is often mistaken for being a technology company. But technology companies make money on software subscriptions—like Salesforce does, or sales commissions—like Amazon does.

Google sells ads to make money. And all of Google’s offerings are designed to make those paid advertisements perform so well that advertisers don’t care if pricing is unfairly high or undisclosed. That is what being a media company means.

Despite this, when the real estate industry says they use Google advertising for lead gen, what they are saying is they buy ads from Google that work so well that they are considered a cost-of-gross sale (COG) instead of a marketing expense (OpEx). This financial accounting magic explains Google’s economic superpower (and antitrust threats).

Google excels at two things: getting clicks, and giving themselves full credit for clicks.

After a Super Bowl TV ad airs, people at home open their Google Chrome browser (65% of the market), then use the Google search bar (87% share), and type in “Coldwell Banker”. When a person uses a Google search bar to find ColdwellBanker.com, Google is the last media company to “touch” the consumer, and the Google homework report (called Google Analytics) will bluntly show the Coldwell Banker CMO that “Google delivered you home buyers.”

Did the $5M Super Bowl spot help Coldwell Banker? Or the magazine ad? Or Hulu ad? Or the guy sitting next to you who works for Coldwell Banker? Or the 100 years of Coldwell Banker brand equity?

Remember, Google makes billions on ad clicks. When does a person click on an ad? Usually not until after multiple exposures and they have pre-determined that it is a product/service they would like to purchase.

Google and their real estate lead generation clients LOVE clicks because it implies consumer intent to see a property. But every other company competing with Google decries clicks because a click is the last thing a person does after a much longer consideration path that Google does not necessarily influence.

However, the existential crises for Google is: people aren’t clicking on ads as often.

Why? Because people are not using large-screen computers all day reading text-based articles and clicking on the relevant ads like they once did when Google was invented. Our media consumption habits have evolved towards reading content on our phones, watching videos and streams, quickly scrolling through feeds, shopping on commerce sites, and now using our voices to command our lives. None of these behaviors generate advertising clicks, but it is how most media is consumed.

Am I advertising to capture someone who already wants my product, or am I advertising to find new people to want my product?

Real estate is obsessed with lead generation. When they say marketing, they mean lead gen. When they say lead gen, they mean marketing. Google is the uncontested King of lead generation for every company in the world. But people don’t search for things they don’t know exist.

Real estate brands, like all companies that depend on search engines for leads, must ask:

Does Google simply charge advertisers for clients they would have captured regardless?

Of course the answer is: Sometimes.

But there is a diminishing return on clicks and search advertising. Google is probably the best digital mouse trap invented, so it catches a lot of home buyers and renters researching a move. But that doesn’t mean it’s the only mousetrap.

In real estate, people experience life events before they decide to move or go to Google or Zillow. In order to find and convert the most qualified leads, Marketers need to strategically consider both

- Demand generation creates intent where it does not yet exist

- Lead generation is converting pre-existing intent into a customer

Real estate brands resort to spending more money with Google because hopping over all the walled gardens is complicated.

A “walled garden” is a slightly envious term for media companies so big and data-rich that they have the market power to prevent data transferring outside of their own ecosystem—ie. into different walled gardens or back into a client’s own ecosystem, like a CRM, sales, or analytics dashboard. Most advertisers would like to follow a single ad across Google, Amazon, and Facebook to mimic how people browse content on phones, TVs, smart speakers, and computers. But, each of these walled gardens won’t let advertisers track this one ad outside of their respective platform “walls.” This inability for advertisers to track ads across the walled gardens makes for time, manual labor and cost to learn which ads people have seen and which work best. Marketing agencies partially exist to unify this measurement across multiple channels.

Google: Judge, Jury & Executioner

Google has been in the news lately in ways that will impact the real estate industry starting in 2021. The three big regulatory issues are all complex, but will certainly make it harder for real estate brands to generate the same volume or quality of consumer leads they have been used to:

- Cookies: Google itself announced it will be diminishing the use of “cookie” ad targeting technology across its ecosystem in order to protect consumer privacy in keeping with various regulations like GDPR in Europe and CCPA in California. This is an example of Google creating industry self-regulation that makes it harder to target and track ads for companies that use Google products. New technology is being planned to eventually replace the 1.0 cookie technology, which will require new skill to execute. Google is so big and central to digital media it is planning to rewrite the technology standards and get everyone to use its solution instead of the universal cookie.

- FHA: Google plans to follow in Facebook’s footsteps by limiting potentially discriminatory ad targeting for real estate companies using its products by the end of 2020. If Facebook’s policies are indicators—and they are—real estate brands will not be able to show ads to specific demographics or geographic audience groups. You can read more here about these pending, misunderstood changes.

- Antitrust: Google controls the buying, selling, and measurement of 1) the ads they sell themselves and 2) ads sold by other companies (see below for how the US Senate’s antitrust case centers on this problem).

When advertisers accuse Google of ‘grading their own homework’ it means that Google limits the reporting that clients are able to pull after running ads on its platform. By supplying only curated reporting, advertisers only see what Google wants them to see, not what the advertisers want to see.

Senate hearings have focused on how Google generates margin, uses technology to obscure margins, and competes unfairly within the marketplace.

“Google doesn’t tell me how much the publisher is receiving for displaying my ad or how much money from each advertising dollar Google might be keeping for itself…It seems like that might be frustrating for an advertiser who’s trying to figure out whether or not she’s getting a good deal and consider comparison shopping.” – Sen. Mike Lee, R-UT, and chairman of the subcommittee

For real estate brands trying to figure out if any of this matters for their 2020 business, the answer is that it does not. It will start to impact the 2021 real estate Spring season—and then it could matter a lot, when leads, lead quality, and even basic targeting parameters disappear from the Google ad manager suite.

The way to sell homes is with a symphony of marketing and measurement across channels, vendors, content, and ad companies. This is more work, but worth it.

Google is an amazing company. Their products help real estate agents and enterprises easily reach huge numbers of clients at low cost. So, what’s the problem? Technology, policy, and consumers are changing, and real estate marketing must change with them.

- Learn new tricks: Lead gen using Google will be different by the end of 2021. There is a sprawling industry of independent companies that can recreate what Google does or wholesale Google products. While there is a learning curve to using alternate methods and vendors, they are well worth learning.

- Pay attention to current events: Complex changes like cookie technology, FHA, and antitrust are seldom actionable or urgent—that is until they are implemented and your marketing funnel turns into a marketing flop in a single season.

- By the end of 2021, you may want to plan on having a new list of vendors, technologies, and employees who can manage cross-channel, non-click, data-driven marketing to real people searching for homes. Sure, you will still want a strong search and Google plan, but you will need a whole lot more than that.

Disclaimer: I am the CEO of Audience Town, a digital advertising platform for the real estate industry that buys services from Google while competing with them at the same—a fitting summary as to how pervasive Google is. You can reach me at ed@audiencetown.com